|

|||||||

| mortgage internet technologies inc | interest rates on reverse mortgages | mortgage interst rate compairison |

Mortgage Tax Savings Calculator - Financial Calculators from ...

Mortgage Tax Savings Calculator: Interest and points paid for a home mortgage are tax deductible . Interest Only Mortgage, Fixed Rate Mortgage vs. LIBOR .

http://www.dinkytown.net/java/MortgageTaxes.html

Mortgage tax deduction calculator

Any interest paid on first or second mortgages over this amount is not tax deductible. . You should also be aware that the total tax savings may be less for higher .

http://www.bankrate.com/calculators/mortgages/loan-tax-deduction-calculator.aspx

|

Search Forums (mortgage introducer schedule) |

Business Search - 14 Million verified businesses |

|

|

|

03-13-2009, 11:40 AM

nh individual health insurance

03-13-2009, 11:40 AM

nh individual health insurance

|

|||

|

|||

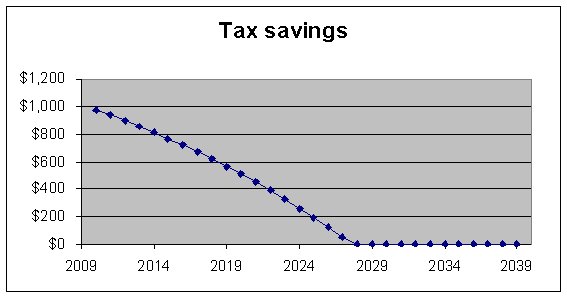

mortgage interest vs tax savings

mortgage interest vs tax savings

15-year vs. 30-year mortgage calculator Mortgage Interest Tax Deductions The Tax Benefits of Home Ownership | AllLaw.com Home Mortgage Interest and Property Tax Deduction |

|

|

|

|

|||

|

|||

|

Calculating The Mortgage Tax Break - Mortgage Interest Deduction ... How do I Calculate Tax Savings on Mortgage Interest? - Budgeting ... A Primer on Homeowner Tax Breaks - SmartMoney.com  |

|

|

|||

|

|||

|

How to Find a Mortgage Deduction's True Value | Real Estate ... |

|

|

|||

|

|||

|

What are the tax savings generated by my mortgage? | Calculators ... |

|

|

|||

|

|||

|

Is the Home Mortgage Interest Tax Deduction a Good Deal? Ask the Readers: Pay Off the Mortgage or Keep the Money in Savings? Tax Savings : Mortgage Calculator and Budgeting Tools : HGTV ... |

|

|

|||

|

|||

|

Quote:

How to Calculate Tax Savings From a Mortgage - Budgeting Money |

|

|

|||

|

|||

|

MacDonald & Walczak - Financial Tools Free Mortgage Calculators Your Money - Have Extra Cash to Cut Mortgage? Nice, but Wait ... |

|

|

|||

|

|||

|

Mortgage Interest Tax Deduction on Rental Property » My Money Blog Tax Expenditure of the Week: The Mortgage Interest Deduction Mortgage Tax Savings Calculator - Financial Calculators |

|

|

|||

|

|||

|

True Mortgage Real Cost Interest Rate After Taxes Calculator Tax Rules for Second Homes - Kiplinger Article: Pay off home mortgage— lose tax deduction? Mortgage Tax Savings Calculator - Ent Federal Credit Union Resources - Calculators - Mortgage Comparison: 15 years vs. 30 ... Mortgage comparison: 15 years vs. 30 years Hugh's Personal Finance Myths Pay Off Mortgage, Lose Tax Deduction? | Truthful Lending |

|

15-Year vs. 30-Year Mortgage - Homes For Sale By Owner - Search ... Retirement Saving Versus Mortgage Paydowns |

|

|

|

|

How Much Are You Really Saving with the Mortgage Interest ...

Does Mortgage Interest Save on Taxes? . or employer related deductions like 401k investments or Health Savings Account contributions.

http://www.nodebtplan.net/2010/07/12/how-much-are-you-really-saving-with-the-mortgage-interest-deduction/