|

|||||||

Mortgage Interest Tax Savings Calculator - Yahoo! Real Estate

Yahoo! Real Estate - Calculate your mortgage interest deduction and potential tax savings from your mortgage. It may surprise you how much you can save in .

http://realestate.yahoo.com/calculators/tax_savings.html

Mortgage Tax Deduction Calculator - Money-zine.com

Using the loan amount, interest and tax rate, this mortgage calculator provides the monthly payment as well as the annual tax deduction and remaining principal .

http://www.money-zine.com/Calculators/Mortgage-Calculators/Mortgage-Tax-Deduction-Calculator/

|

Search Forums (mortgage interesting) |

Business Search - 14 Million verified businesses |

|

|

|

03-13-2009, 11:40 AM

bankers conseco life insurance company

03-13-2009, 11:40 AM

bankers conseco life insurance company

|

|||

|

|||

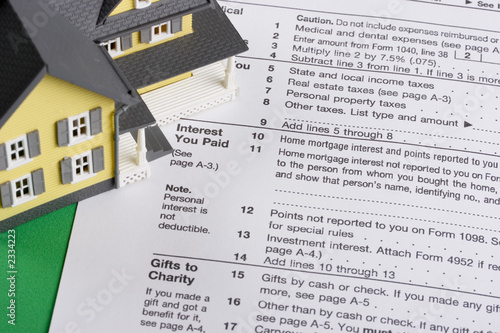

mortgage interest tax refund calculator

mortgage interest tax refund calculator

Mortgage Tax Return Benefits Calculator :: Online Mortgage ... Home Mortgage Interest Income Tax Deduction 2011, 2012 - YouTube Tax Refund Calculator | CreditFYI.com Home Mortgage Interest and Property Tax Deduction |

|

|

|

|

|||

|

|||

|

How Deductible is your mortgage interest? Mortgage Tax Calculator - Tax Benefits of Owning Realestate Calculator for true value of mortgage interest write-off ...  |

|

|

|||

|

|||

|

Financial Calculators | Mortgage Calculator | Tax Calculators |

|

|

|||

|

|||

|

Mortgage Calculator Estimates Mortgage Interest Tax Deduction |

|

|

|||

|

|||

|

How do I Qualify for a Mortgage Interest Tax Deduction? | Home ... Mortgage Interest Tax Deduction Calculator 2011, 2012 Tips For Using Your Mortgage For Tax Benefits - Mortgage Calculators |

|

|

|||

|

|||

|

Quote:

Calculating The Mortgage Interest Tax Deduction |

|

|

|||

|

|||

|

Mortgage Tax Savings Calculator - Home Ownership, Deductions ... The U.S. Mortgage Interest Deduction by Income Level | MyGovCost ... |

|

|

|||

|

|||

|

Deducting Mortgage Interest FAQs - TurboTax® Tax Tips & Videos mortgage interest tax deduction (real estate, property tax, credit ... Mortgage Tax Deduction Calculator |

|

|

|||

|

|||

|

Rent vs. Buy Mortgage Calculator The Tax Benefits of Home Ownership | AllLaw.com Pay Off Mortgage, Lose Tax Deduction? | Truthful Lending Navy Federal Credit Union: Mortgage Tax Savings Calculator Navy Federal Credit Union: Mortgage Tax Savings Calculator Mortgage Payment Calculator - SmartMoney.com The Golden 1 Credit Union | Mortgage Taxes calculator Mortgage interest tax deduction: Does it make sense? - DailyFinance Mortgage Tax Savings Calculator - 360 Degrees of Financial Literacy |

|

Is Home Mortgage Interest Tax Deductible? - Budgeting Money FirstMerit Bank - Mortgage Tax Savings Calculator |

|

|

|

|

Mortgage Tax Savings Calculator

Learn more about Mortgage Tax Savings Calculator at https://www.ent.com. . Our calculator limits your interest deduction to the interest payment that would be .

https://www.ent.com/personal/education-center/calculators/mortgage-tax-savings-calculator