|

|||||||

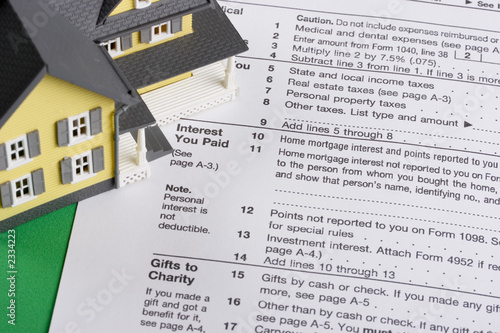

Mortgage Interest Tax Savings Calculator - Yahoo! Real Estate

With the interest on a mortgage being deductible when you itemize deductions, it may surprise you how much you can save in taxes. Use this calculator to .

http://realestate.yahoo.com/calculators/tax_savings.html

How Deductible is your mortgage interest?

This calculator calculates how much federal income tax you save now from your itemized deductions (mortgage interest, property tax, charitable contributions, .

http://www.hughchou.org/calc/deduct.php

|

Search Forums (amica mutual auto insurance) |

Business Search - 14 Million verified businesses |

|

|

|

03-13-2009, 11:40 AM

mortgage interest tax write off

03-13-2009, 11:40 AM

mortgage interest tax write off

|

|||

|

|||

mortgage interest tax deduction calculator

mortgage interest tax deduction calculator

Home Mortgage Interest and Property Tax Deduction Mortgage Tax Deduction Calculator - Money-zine.com Mortgage Tax Calculator - Tax Benefits of Owning Realestate Mortgage Interest Tax Deduction Calculator 2011, 2012 |

|

|

|

|

|||

|

|||

|

Home Mortgage Interest Income Tax Deduction 2011, 2012 - YouTube Mortgage Calculator Estimates Mortgage Interest Tax Deduction Mortgage Interest Deduction: Homeowners' Biggest Tax Perk ...  |

|

|

|||

|

|||

|

Tips For Using Your Mortgage For Tax Benefits - Mortgage Calculators |

|

|

|||

|

|||

|

How do I Qualify for a Mortgage Interest Tax Deduction? | Home ... |

|

|

|||

|

|||

|

Is Home Mortgage Interest Tax Deductible? - Budgeting Money Tax - Mortgage Interest Tax Deductions Available When Buying a ... Home Ownership Tax Benefits - Mortgage Calculator |

|

|

|||

|

|||

|

Quote:

How to Find a Mortgage Deduction's True Value | Real Estate ... |

|

|

|||

|

|||

|

The U.S. Mortgage Interest Deduction by Income Level | MyGovCost ... The Tax Benefits of Home Ownership | AllLaw.com |

|

|

|||

|

|||

|

True Mortgage Real Cost Interest Rate After Taxes Calculator Should I itemize or take the standard deduction? | Calculators by ... Tax Benefits With Home Mortgae | Buyers Basics | Home Finance |

|

|

|||

|

|||

|

The Golden 1 Credit Union | Mortgage Taxes calculator Pay Off Mortgage, Lose Tax Deduction? | Truthful Lending FirstMerit Bank - Mortgage Tax Savings Calculator Factors To Determine If Your Mortgage Interest Is Tax Deductible Mortgage Interest Tax Deductions Mortgage Tax Savings Calculator - Howard Hanna Mortgage Services Mortgage Payment Calculator - SmartMoney.com Navy Federal Credit Union: Mortgage Tax Savings Calculator |

|

Mortgage Tax Savings Calculator Mortgage Tax Savings Calculator - DHI Mortgage |

|

|

|

|

Housing industry: Don't mess with mortgage tax break - Dec. 2, 2010

Dec 2, 2010 . Don't even think of touching the mortgage interest tax deduction in the midst of a fragile housing market. The housing industry came out with .

http://money.cnn.com/2010/12/02/news/economy/mortgage_interest_deduction/index.htm