|

|||||||

| mortgage interest rates va | mortgage interest rates still falling 2009 | mortgage interest rates southern california |

Standard or itemized tax deduction?

Jan 20, 2012 . But individuals who spend a lot on medical care, mortgage interest, state . details on itemized deductions, see the instructions for Schedule A, .

http://www.bankrate.com/finance/taxes/standard-or-itemized-tax-deduction.aspx

Calculating The Mortgage Interest Tax Deduction

Mar 29, 2011 . If the couple itemized their deductions on Schedule A, the mortgage deduction would come to $4200. Even without a mortgage interest .

http://www.investopedia.com/articles/mortgages-real-estate/11/calculate-the-mortgage-interest-math.asp

|

Search Forums (mortgage interest saving system) |

Business Search - 14 Million verified businesses |

|

|

|

03-13-2009, 11:40 AM

australia mortgage reduction

03-13-2009, 11:40 AM

australia mortgage reduction

|

|||

|

|||

mortgage itemization table

mortgage itemization table

2011 Instruction 1040 Schedule A Mortgage Insurance Premiums - Itemized Tax Deduction for ... Tax Filing Delay: IRS Announces Filing Date for Itemized Returns ... The Tax Foundation - Most Americans Don't Itemize on Their Tax ... |

|

|

|

|

|||

|

|||

|

Itemized Deductions IRS Schedule A – Itemized Deductions | Suite101.com Can I deduct the closing costs from purchasing my home?  |

|

|

|||

|

|||

|

2103 Mortgage Loan Broker Regulations Itemized Schedule of ... |

|

|

|||

|

|||

|

Things You Can Itemize When Filing Your Taxes | eHow.com |

|

|

|||

|

|||

|

Taxes: Standard Deduction vs. Itemized Deductions Deductions for Property Taxes and Mortgage Interest and the ... IRS Says Tax Season Will Be Delayed for Some |

|

|

|||

|

|||

|

Quote:

15- vs. 30-year mortages compared |

|

|

|||

|

|||

|

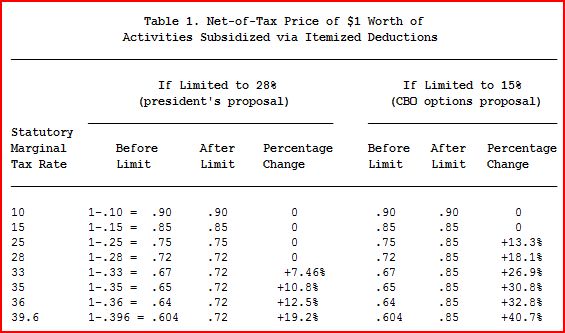

Mortgage Amortization Calculator, Table/chart - Calculate ... TPC Tax Topics | 2012 Budget - Limit Value of Itemized Deductions ... |

|

|

|||

|

|||

|

Tax - Mortgage Interest Tax Deductions Available When Buying a ... Itemized vs. Standard Tax Deduction – Which One Should You Take ... limiting itemized deductions - OMB Watch |

|

|

|||

|

|||

|

Standard Deduction or Itemized Deduction? : Money Smart Life State Disclosure Matrix 7/22/11 State State Specific Disclosure ... Itemized Deductions/Standard Deductions > Real Estate (Taxes ... Regulation Z - Truth In Lending Act Regulation Z - Truth in Lending § 226.18 Itemized deductions How to File Taxes Jointly While Married - Budgeting Money Should You Itemize or Take the Standard Deduction? - For Dummies |

|

Itemized Deduction vs Standard Deduction - Difference and ... Fees Chart for Mortgage Lending |

|

|

|

|

OLT TAX CORNER ~ Itemized Deductions

10. Can I itemize deductions if I am filing married filing separately if my spouse is not itemizing? 11. Where can I find the Optional State Sales Tax Tables? 12.

http://www.olt.com/main/tc/tcfeditemded.asp