|

|||||||

TPC Tax Topics | Restructuring the Mortgage Interest Deduction

Options to Restructure Mortgage Interest Deduction in 2015 .

http://www.taxpolicycenter.org/taxtopics/Restructuring-the-Mortgage-Interest-Deduction.cfm

Reforming the Mortgage Interest Deduction - Urban Institute

Apr 1, 2010 . The mortgage interest deduction (MID) is the largest single federal . The MID was not originally placed in income tax law to subsidize home ownership. . reduction options.4 The MID disproportionately benefits taxpayers in .

http://www.urban.org/url.cfm?ID=412099

|

Search Forums (mortgage interest relief and marriage) |

Business Search - 14 Million verified businesses |

|

|

|

03-13-2009, 11:40 AM

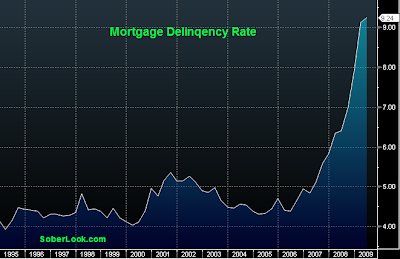

mortgage info with line graph

03-13-2009, 11:40 AM

mortgage info with line graph

|

|||

|

|||

mortgage interest reduction option act

mortgage interest reduction option act

Reforming the Mortgage Interest Deduction - Urban Institute Servicemembers Civil Relief Act (SCRA) - Mortgage Interest Rate ... 888-620-9163 / 8886209163 Deficit Commission Draft Would Eliminate Mortgage Interest ... |

|

|

|

|

|||

|

|||

|

It's not often that I get to tell you something isn't a scam: “ACT” letters ... Tax Deductions On Mortgage Interest Cash Disbursement Request (Form 571)  |

|

|

|||

|

|||

|

Interest-Only Mortgages - How To Information | eHow.com |

|

|

|||

|

|||

|

Types of Mortgage Loans: Fixed and Adjustable Rate Mortgages ... |

|

|

|||

|

|||

|

FinAid | Loans | Loan Tradeoffs - Public vs. Private Causes of the United States housing bubble - Wikipedia, the free ... Bank of America Home Loans |

|

|

|||

|

|||

|

Quote:

Know Before You Go... To Get a Mortgage |

|

|

|||

|

|||

|

Tax Law Changes Mortgage Glossary - Heartland Bank and Trust Company |

|

|

|||

|

|||

|

Costs and Benefits of Housing Subsidies 2011-16 (Attachment): Servicemembers Civil Relief Act of 2003 ... Interest-Only Mortgage Payments and Payment-Option ARMs |

|

|

|||

|

|||

|

Rate-Improvement Mortgage Definition | Investopedia Roots of the Crisis | FreedomWorks Bradley/Bourbonnais | Refinance Mortgage Interest Rate | Interest ... Attention: TN Real Estate - Terms home mortgage interest tax deduction | Real Estate Experts LA Green Testifies at Senate Hearing on Homeownership | USC News Americans Have Their Say in Reducing the National Debt ... McDermott, Larson and Berkley Introduce the “Homeowners Tax ... |

|

Preparing Legal Documents Ahead of a Deployment | Military.com Mortgage Modification and Refinancing Under the Making Home ... |

|

|

|

|

Reduce Your Interest Rate - The Relocation Mortgage Program

If you have an adjustable-rate (ARM) or a balloon mortgage, reduced interest . be effective if you consider your refinancing goals and select the option that may . entitled to under the Servicemembers Civil Relief Act or applicable state law.

https://www.wellsfargorelo.com/loans/yourcompany1096/debt-management/lower-interest-rates/index.page