|

|||||||

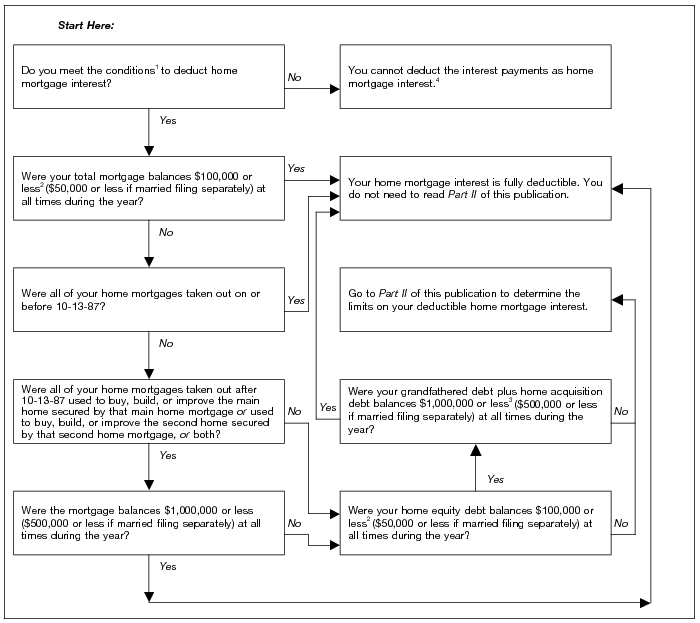

Publication 936 (2011), Home Mortgage Interest Deduction

It includes discussions on points, mortgage insurance premiums, and how to report deductible interest on your tax return. Generally, home mortgage interest is .

http://www.irs.gov/publications/p936/ar02.html

2011 Publication 936

mortgage interest, including points and mort-. Internet IRS.gov gage insurance premiums. It also explains how to report deductible interest on your tax return.

http://www.irs.gov/pub/irs-pdf/p936.pdf

|

Search Forums (mortgage intermediaries) |

Business Search - 14 Million verified businesses |

|

|

|

03-13-2009, 11:40 AM

digital credit card payment systems

03-13-2009, 11:40 AM

digital credit card payment systems

|

|||

|

|||

mortgage interest tax deduction

mortgage interest tax deduction

Home mortgage interest deduction - Wikipedia, the free encyclopedia Mortgage tax deduction calculator - Bankrate.com The Tax Benefits of Home Ownership | AllLaw.com Home Mortgage Interest Deduction - Tax Planning: US - About.com |

|

|

|

|

|||

|

|||

|

Is It Time to Kill the Mortgage Interest Tax Deduction? - DailyFinance Mortgage interest tax deduction: safe until after 2012 election ... The Mortgage Interest Tax Deduction - Slate Magazine  |

|

|

|||

|

|||

|

Md. proposes cap on mortgage interest tax deductions - Where We ... |

|

|

|||

|

|||

|

Mortgage Interest Tax Deductions |

|

|

|||

|

|||

|

Mortgage Tax Deduction Calculator - Money-zine.com Despite Critics, Mortgage Interest Deduction Persists - NYTimes.com Home Mortgage Interest and Property Tax Deduction |

|

|

|||

|

|||

|

Quote:

Tax - Mortgage Interest Tax Deductions Available When Buying a ... |

|

|

|||

|

|||

|

Claiming the Mortgage Interest Tax Deduction | Rocket Lawyer Tax deductions: 12 ways to save, from mortgage interest to moving ... |

|

|

|||

|

|||

|

Time to end the mortgage interest tax deduction | Reuters Money Mortgage Interest Deduction Softens Blow as “Tax Day” Approaches ... Should the mortgage-interest tax deduction be cut? | Marketplace ... |

|

|

|||

|

|||

|

Ax may fall on tax break for mortgages - TheHill.com Home Mortgage Interest Tax Deduction | Enemy of Debt: Where ... Income Tax Deductions: Home Mortgage Interest FAQs IRS Tip : Maximize Your Mortgage Interest Tax Deductions ... Is Your Mortgage Interest Deduction Doomed? - CBS News Income Tax Deductions: Home Mortgage Interest FAQs Kansas Gov. Brownback's tax plan ends mortgage deduction ... Mortgage Interest Deductions | Home Equity Loans Interest ... Mortgage Interest Deduction Is Bad Policy | Mortgage Tax Deduction ... |

|

Deducting Mortgage Interest FAQs - TurboTax® Tax Tips & Videos Tax Benefits With Home Mortgae | Buyers Basics | Home Finance |

|

|

|

|

Eliminating the mother of all tax deductions | Deseret News

Nov 21, 2011 . Mortgage interest break takes biggest chunk out of tax base . Over the years, the mortgage interest deduction has been targeted for reduction .

http://www.deseretnews.com/article/700200108/Eliminating-the-mother-of-all-tax-deductions.html