|

|||||||

Publication 936 (2011), Home Mortgage Interest Deduction

It includes discussions on points, mortgage insurance premiums, and how to report deductible interest on your tax return. Generally, home mortgage interest is .

http://www.irs.gov/publications/p936/ar02.html

Home mortgage interest deduction - Wikipedia, the free encyclopedia

An indirect method for making interest on mortgage for personal residence tax deductible in Canada is through an asset swap, whereby the homebuyer sells his .

http://en.wikipedia.org/wiki/Home_mortgage_interest_deduction

|

Search Forums (mortgage interest tax refund) |

Business Search - 14 Million verified businesses |

|

|

|

03-13-2009, 11:40 AM

mortgage formula afford

03-13-2009, 11:40 AM

mortgage formula afford

|

|||

|

|||

mortgage interest tax deductibility

mortgage interest tax deductibility

Home Mortgage Interest Deduction - Tax Planning: US - About.com Mortgage tax deduction calculator The Mortgage Interest Tax Deduction - Slate Magazine Mortgage Interest Tax Deductions The Tax Benefits of Home Ownership | AllLaw.com |

|

|

|

|

|||

|

|||

|

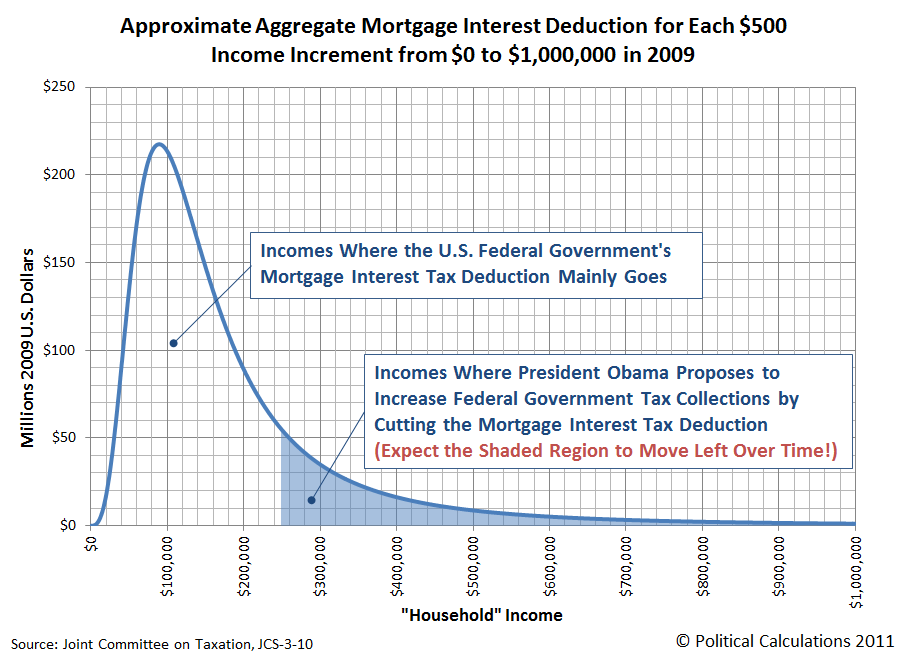

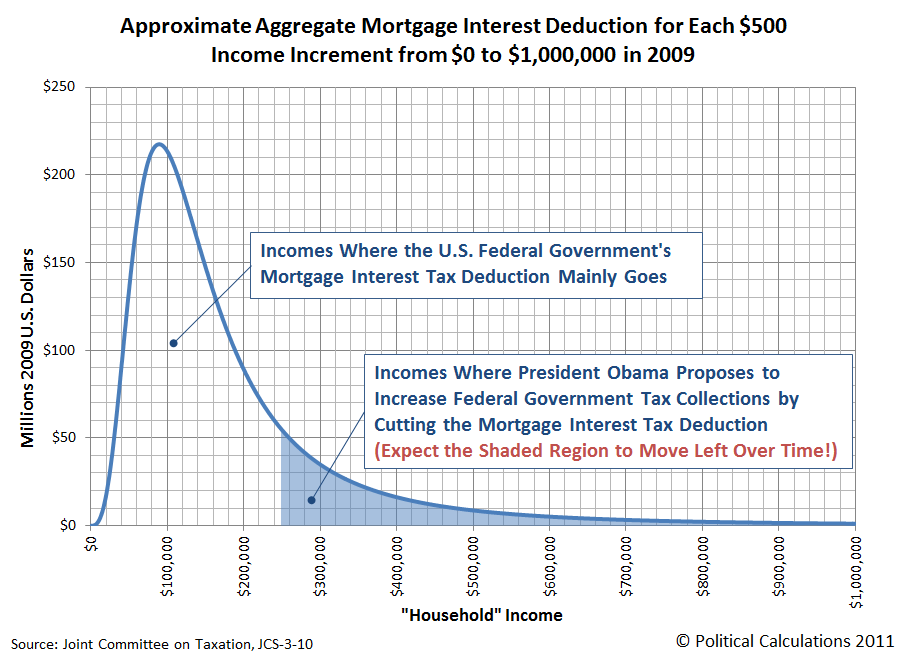

Is the Home Mortgage Interest Tax Deduction a Good Deal? Is It Time to Kill the Mortgage Interest Tax Deduction? - DailyFinance Mortgage interest tax deduction a debt talk target? - Political ...  |

|

|

|||

|

|||

|

Despite Critics, Mortgage Interest Deduction Persists - NYTimes.com |

|

|

|||

|

|||

|

Tax Expenditure of the Week: The Mortgage Interest Deduction |

|

|

|||

|

|||

|

Owning real estate, what's tax deductible? Tax - Mortgage Interest Tax Deductions Available When Buying a ... Ax may fall on tax break for mortgages - TheHill.com |

|

|

|||

|

|||

|

Quote:

Mortgage Interest Tax Savings Calculator - Yahoo! Real Estate |

|

|

|||

|

|||

|

Home Mortgage Interest and Property Tax Deduction Mortgage interest tax deduction may be in danger | HousingWire |

|

|

|||

|

|||

|

Income Tax Deductions: Home Mortgage Interest FAQs Toll: Eliminating Mortgage Interest Tax Deduction Is 'Selfish ... 2011 Publication 936 |

|

|

|||

|

|||

|

Mortgage Tax Deduction Calculator Tax Benefits With Home Mortgae | Buyers Basics | Home Finance Eliminating the mother of all tax deductions | Deseret News Eliminating the mother of all tax deductions | Deseret News Shrink the mortgage interest tax deduction?- Home financing - MSN ... How to Deduct Home Mortgage Loan Interest | eHow.com Mortgage Interest Tax Break No Longer Sacred? : NPR |

|

Still too hot to touch: The mortgage interest tax break - Apr. 14, 2010 Proposal to Limit or Eliminate Tax Deduction for Homes Is ... |

|

|

|

|

|

Mortgage Interest Deductions | Home Equity Loans Interest ...

Jan 3, 2012 . Deducting mortgage interest is a great tax benefit that can make home ownership more affordable. Your first mortgage isn't the only loan that .

http://www.houselogic.com/home-advice/tax-deductions/deduct-mortgage-interest/