|

|||||||

Home mortgage interest deduction - Wikipedia, the free encyclopedia

An indirect method for making interest on mortgage for personal residence tax deductible in Canada is through an asset swap, whereby the homebuyer sells his .

http://en.wikipedia.org/wiki/Home_mortgage_interest_deduction

Home Mortgage Interest Deduction - Tax Planning: US - About.com

Home Mortgage Interest is a tax-deductible expense. Mortgage interest is reported on Form 1040, Schedule A along with other itemized deductions such as real .

http://taxes.about.com/od/deductionscredits/a/MortgageDeduct.htm

|

Search Forums (mortgage interest tax deduction second home) |

Business Search - 14 Million verified businesses |

|

|

|

03-13-2009, 11:40 AM

mortgage interest tax deductions

03-13-2009, 11:40 AM

mortgage interest tax deductions

|

|||

|

|||

mortgage interest tax deductable

mortgage interest tax deductable

The Tax Benefits of Home Ownership | AllLaw.com Publication 936 (2011), Home Mortgage Interest Deduction Mortgage tax deduction calculator Mortgage Interest Tax Deductions Is the Home Mortgage Interest Tax Deduction a Good Deal? |

|

|

|

|

|||

|

|||

|

Is It Time to Kill the Mortgage Interest Tax Deduction? - DailyFinance Owning real estate, what's tax deductible? Mortgage interest tax deduction: safe until after 2012 election ...  |

|

|

|||

|

|||

|

Tax Expenditure of the Week: The Mortgage Interest Deduction |

|

|

|||

|

|||

|

Mortgage Interest Deduction Softens Blow as “Tax Day” Approaches ... |

|

|

|||

|

|||

|

Mortgage interest tax deduction a debt talk target? - Political ... Time to end the mortgage interest tax deduction | Reuters Money Is Your Mortgage Interest Deduction Doomed? - CBS News |

|

|

|||

|

|||

|

Quote:

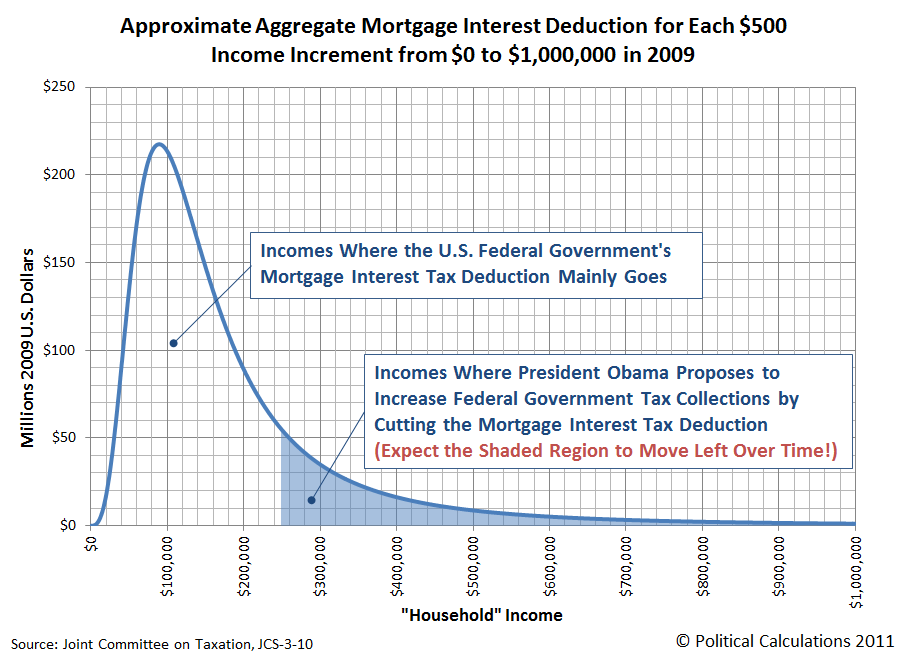

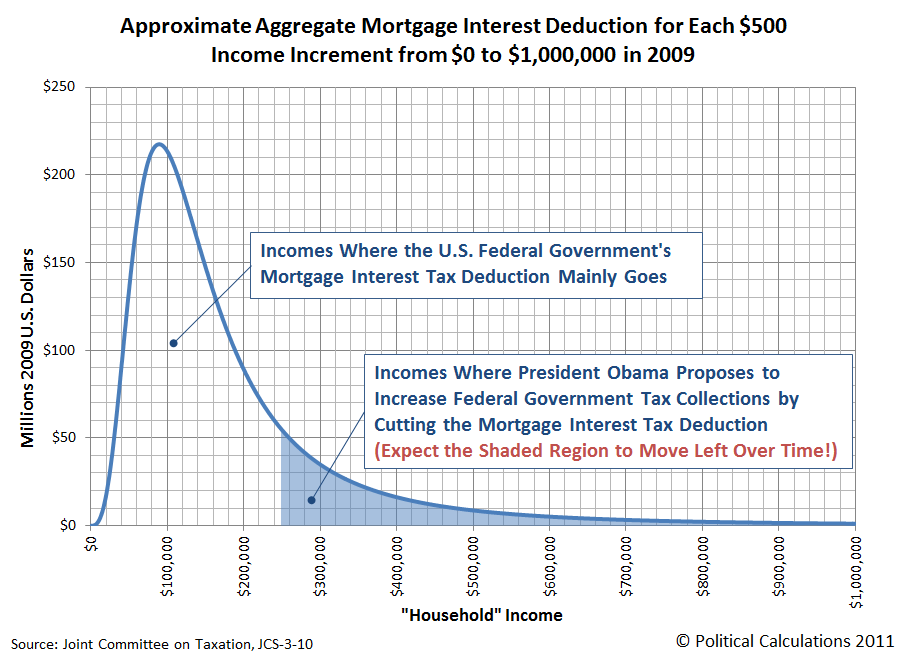

Mortgage Estimate | Estimate of mortgage interest tax deduction's ... |

|

|

|||

|

|||

|

Should the mortgage-interest tax deduction be cut? | Marketplace ... How Deductible is your mortgage interest? |

|

|

|||

|

|||

|

Barney Frank says mortgage interest tax deduction is safe ... Mortgage Tax Break Proposal Is a Message - News Analysis ... Home Mortgage Interest Tax Deduction | Enemy of Debt: Where ... |

|

|

|||

|

|||

|

Is Elimination of the Mortgage Interest Tax Deduction Inevitable? The Mortgage Interest Tax Deduction - Slate Magazine Mortgage interest tax deduction cut criticized Deducting Mortgage Interest FAQs - TurboTax® Tax Tips & Videos Mortgage Interest Deduction Is Bad Policy | Mortgage Tax Deduction ... 2011 Publication 936 Mortgage Interest Tax Deduction Isn't The Best Way To Help ... IRS Tip : Maximize Your Mortgage Interest Tax Deductions ... |

|

deductible mortgage points interest deduction refinancing Proposal to Limit or Eliminate Tax Deduction for Homes Is ... |

|

|

|

|

Mortgage Interest Tax Break No Longer Sacred? : NPR

Feb 12, 2011 . "[Getting] rid of the mortgage interest tax deduction would just kill the market," says Wendy Rocca, a Realtor for Century 21 in Watertown, Mass.

http://www.npr.org/2011/02/12/133692504/mortgage-interest-tax-break-no-longer-sacred